The European Commission considers that reviewing the weighted average cost of capital (WACC) at least once per year is appropriate to take account of recent economic conditions, but many countries adopt a longer periodicity, and some update it only when doing a new market analysis.

When setting regulated wholesale prices, national regulatory authorities (NRA) must allow for a reasonable return (Article 74.1 EECC). NRAs can do this by estimating the cost of capital of an efficient operator as a weighted average between the return investors expect on their equity and the financing costs of loans and other debts.

In the WACC formula:

- R(E) is the cost of equity;

- R(D) is the cost of debt;

- E is the value of equity;

- D is the value of debt;

- D+E is company value.

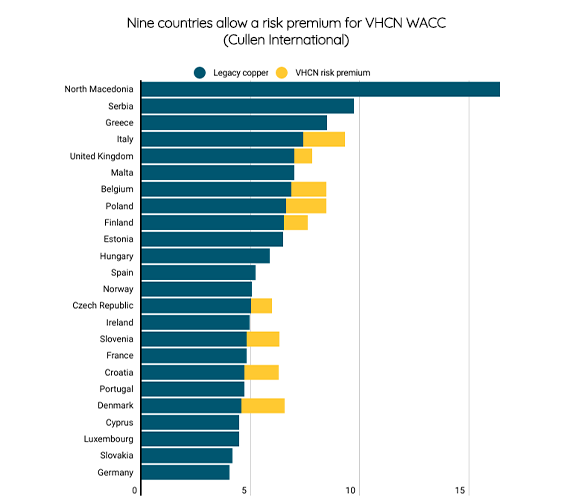

NRAs must also take into account any risks specific to a particular new investment network project (Article 74.1 EECC). Some NRAs therefore allow for a higher cost of capital for investments in very high capacity networks (VHCN) with a risk premium, which would translate into higher wholesale access prices on those networks if they are regulated.

Our benchmark compares for 32 European countries:

- WACC values and the parameters NRAs use;

- risk premiums for VHCN; and

- how often NRAs review the WACC.

To access the full benchmark, please click on “Access the full content” - or on “Request Access”, in case you are not subscribed to our European Telecoms service.

more news

25 April 25

FTTH roll-out in MENA expands with different approaches to deployment

Our latest NGA deployments benchmark shows that all of the 13 studied countries in the Middle East and North Africa region (MENA) have started to deploy fibre-to-the-home (FTTH) networks.

24 April 25

Understand the EU’s VAT and customs rules for cross-border e-commerce

Cullen International’s new report explains how EU VAT and customs rules apply to imported e-commerce goods, as well as describing the customs reform package, proposed by the European Commission in 2023.

23 April 25

Tower transactions in Europe continue to draw competition scrutiny

The European passive mobile infrastructure markets have seen a large number of mergers and acquisitions in recent years, attracting scrutiny from competition authorities. Cullen International’s new report draws on merger control decisions to explain how competition works in the market and what concerns, if any, authorities have raised about different types of transactions.