More and more mobile network operators (MNOs) are selling their masts to tower companies, while maintaining ownership of the active equipment.

MNOs can either move towers into a fully owned legally separate company or sell, partially or completely, the passive equipment to tower companies or other stakeholders or funds.

Cullen International’s benchmark analyses the business models adopted in 23 European countries, whether tower companies are registered under the general authorisation regime and if governments adopted specific legislation to stop foreign takeover of tower companies.

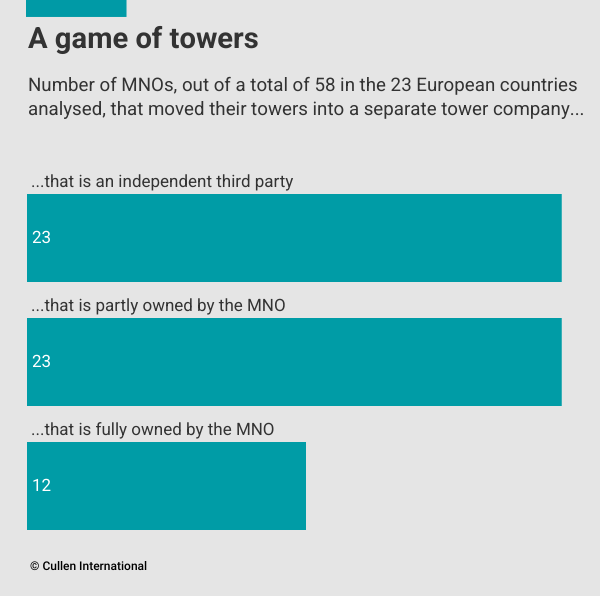

The benchmark found that 46 of the 58 analysed MNOs partially or completely sold their towers.

In many cases, Cellnex bought towers from MNOs. Vantage Towers operates in nine different countries, although not all countries with the presence of Cellnex or Vantage Towers are covered.

In just over half of the analysed countries, tower companies are registered under the general authorisation framework.

No government adopted specific legislation aimed at stopping foreign takeover of towers. However, many countries have general legislation to screen foreign investments in critical sectors.

For more information and access to the full benchmark, please click on “Access the full content” - or on “Request Access”, in case you are not subscribed to our European Telecoms service.

And don't miss our upcoming webinar:

more news

25 April 25

FTTH roll-out in MENA expands with different approaches to deployment

Our latest NGA deployments benchmark shows that all of the 13 studied countries in the Middle East and North Africa region (MENA) have started to deploy fibre-to-the-home (FTTH) networks.

24 April 25

Understand the EU’s VAT and customs rules for cross-border e-commerce

Cullen International’s new report explains how EU VAT and customs rules apply to imported e-commerce goods, as well as describing the customs reform package, proposed by the European Commission in 2023.

23 April 25

Tower transactions in Europe continue to draw competition scrutiny

The European passive mobile infrastructure markets have seen a large number of mergers and acquisitions in recent years, attracting scrutiny from competition authorities. Cullen International’s new report draws on merger control decisions to explain how competition works in the market and what concerns, if any, authorities have raised about different types of transactions.