Cullen International’s latest research shows that postal universal service providers throughout Europe are raising the prices of their letters services. The letters segment has been under particular pressure in recent years due to rapidly falling volumes. Decreasing levels of profitability, and higher operational costs and inflation rates may all be factors behind the price rises.

Cullen International’s national benchmark on the prices of letters and packets shows that the prices of 20 g letter services have risen in the past year in every country monitored except France and Germany.

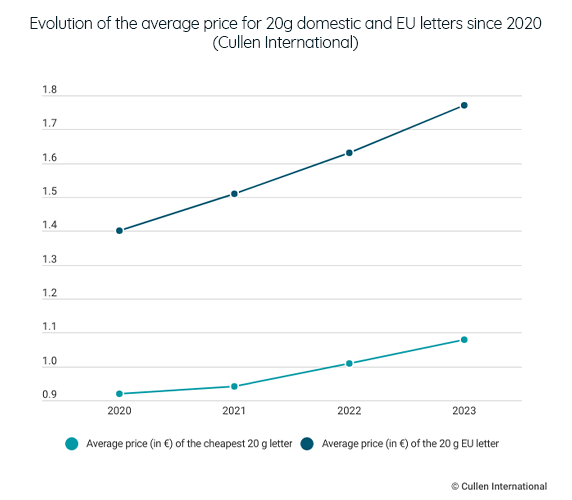

Across the monitored countries, the average price for the cheapest 20 g letter service rose from €0.92 in June 2020 to €1.08 in March 2023, a 17% rise. The price rise was not limited to domestic letters: the average price of intra-EU 20 g letters increased by 26% in the same period to reach €1.77.

There is significant pricing variation between countries. The most expensive 20 g domestic letter service is offered in Finland at €2.10, followed by Norway at €1.93. The cheapest service is offered in Portugal for €0.61.

Cullen International’s Postal service provides comprehensive national benchmarks comparing both letter and parcel pricing. In addition, the service provides benchmarks and reports on the different approaches by national authorities on regulating retail prices.

For more information and to access the benchmark, please click on “Access the full content” - or on “Request Access”, in case you are not subscribed to our European Postal intelligence.

more news

24 April 25

Understand the EU’s VAT and customs rules for cross-border e-commerce

Cullen International’s new report explains how EU VAT and customs rules apply to imported e-commerce goods, as well as describing the customs reform package, proposed by the European Commission in 2023.

23 April 25

Tower transactions in Europe continue to draw competition scrutiny

The European passive mobile infrastructure markets have seen a large number of mergers and acquisitions in recent years, attracting scrutiny from competition authorities. Cullen International’s new report draws on merger control decisions to explain how competition works in the market and what concerns, if any, authorities have raised about different types of transactions.

17 April 25

Four-fifths of European mobile operators partially or completely sold their towers

Our latest benchmark analyses the business models adopted in 23 European countries, whether tower companies are registered under the general authorisation regime and if governments adopted specific legislation to stop foreign takeover of tower companies.