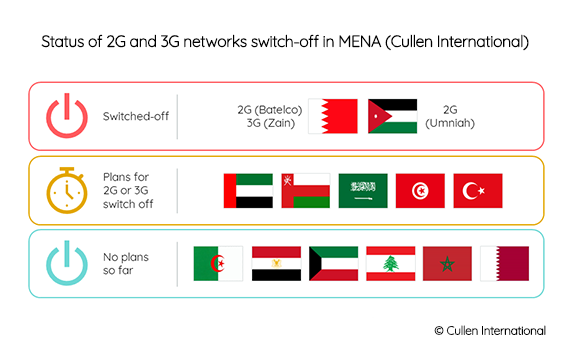

While many operators in MENA countries announced their plans to switch-off 2G and/or 3G networks, so far networks have only been switched off in Bahrain and Jordan.

Batelco, the incumbent mobile network operator in Bahrain, switched off its 2G network in 2021, while Zain Bahrain switched off its 3G network in 4Q 2022. In Jordan, Umniah, the third mobile operator, switched off its 2G network in March 2021.

The regulators in Oman, Türkiye and United Arab Emirates (UAE) are involved in the process for networks' switch-off plans:

- TRA Oman adopted a plan to switch off the country's 3G networks starting from July 2024;

- BTK Türkiye announced that 2G and 3G networks will be switched off in the country in 2026 and 2029, respectively; and

- UAE announced that the 2G networks will be switched off by the end of 2023.

STC in Saudi Arabia and Tunisie Telecom also have plans in place to switch off their 3G networks. However, operators in Algeria and Morocco hold technology-specific licences so that switching off any mobile network (2G or 3G) and reusing the spectrum would be limited by the licence expiry date.

Cullen International’s benchmark explains for 13 MENA countries whether 2G or 3G networks have been switched off or are planned to be switched off. The benchmark also provides details on the plans to deal with those customers who remain reliant on those networks and whether current licences require service providers to continue to provide 2G or 3G services.

To access the full benchmark on 11 countries in the Americas, please click on “Access the full content” - or on “Request Access”, in case you are not subscribed to our MENA Telecoms service.

more news

24 April 25

Understand the EU’s VAT and customs rules for cross-border e-commerce

Cullen International’s new report explains how EU VAT and customs rules apply to imported e-commerce goods, as well as describing the customs reform package, proposed by the European Commission in 2023.

23 April 25

Tower transactions in Europe continue to draw competition scrutiny

The European passive mobile infrastructure markets have seen a large number of mergers and acquisitions in recent years, attracting scrutiny from competition authorities. Cullen International’s new report draws on merger control decisions to explain how competition works in the market and what concerns, if any, authorities have raised about different types of transactions.

17 April 25

Four-fifths of European mobile operators partially or completely sold their towers

Our latest benchmark analyses the business models adopted in 23 European countries, whether tower companies are registered under the general authorisation regime and if governments adopted specific legislation to stop foreign takeover of tower companies.